How to manage personal finance and invest in times of national emergency

National emergencies—whether they’re pandemics, natural disasters, geopolitical conflicts, or economic crises—can upend markets and personal finances overnight. While uncertainty may feel overwhelming, having a structured approach to managing your money and investments can help you weather the storm. This post will guide you through practical steps to protect your financial well‑being and even find opportunities to invest wisely during turbulent times.

So the question is now how to make our financial decision. Here are some guiding thoughts that can help:

1. Know Where You Stand

First things first—get a clear picture of your money. Add up everything you own (like savings, property, investments) and subtract anything you owe (like loans or credit card bills). Also, take a look at how much you’re earning vs. spending each month. This will help you figure out what changes you might need to make.

2. Boost Your Emergency Fund

Now’s the time to make sure you’ve got a solid emergency fund. Ideally, you want 3–6 months of essential expenses saved up. If things feel extra uncertain, aim for more. Keep this money somewhere safe and easy to access—like a savings account. Even small, regular savings can add up quickly.

3. Cut Back on Unnecessary Spending

Tight times call for smart spending. Cancel anything you don’t really need—like that streaming service you never use or the extra online shopping. Cook at home more often, find cheaper alternatives, and try to live a bit leaner until things settle down.

4. Keep Debt Under Control

High-interest debt (like credit cards) can spiral fast during a crisis. Try to pay it down as much as you can. If you’re struggling, talk to your bank—there might be relief options available. And definitely avoid taking on more debt unless it’s absolutely necessary.

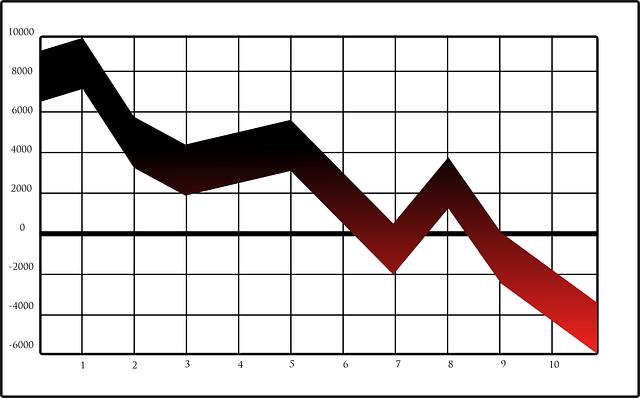

5. Don’t Panic About Investments

Markets can be super unpredictable during a crisis. It’s tempting to sell everything, but try to stay calm. Keep your investments diversified, and if you’ve got extra cash, think about investing a little at a time in strong, long-term assets like index funds or good stocks.

6. Look Into Safer Options

If things feel too risky, it’s okay to play it a bit safe. You might consider putting some money in safer places like government bonds, gold, or inflation-protected options that won’t bounce around as much.

7. Make Sure You’re Properly Insured

This is the time to double-check your health, home, and life insurance. If something unexpected happens, you don’t want to be caught off guard with big bills. If you’re a freelancer or self-employed, income protection insurance might be worth a look too.

8. Keep Your Banking Flexible

Make sure you’ve got access to your money if something goes wrong. Use online banking, keep some credit available, and maybe don’t keep all your money in one bank—just in case there’s an issue with access.

Emergencies can shake things up—but they also push us to get smarter with our money. Cut the waste, stay calm with your investments, and focus on being prepared. With the right mindset and plan, you’ll come through stronger and more financially secure than before.